TL;DR:

This section highlights Merchant Cash Advances (MCAs) as a swift and flexible short-term business funding option. MCAs offer rapid access to capital (often within days), with unique repayment terms tied to daily credit card sales volumes. While they provide adaptability, higher costs compared to traditional financing should be considered. Entrepreneurs can benefit from MCAs for immediate needs and working capital, navigating unpredictable markets and fostering growth in today's dynamic business environment. Key advantages include fast funding, flexible repayments, and quick access to capital, positioning MCAs as a viable short-term solution for higher cost financing.

Choosing the right financial strategy is pivotal for a business’s success. Before optinng for any funding option, understanding your business needs is paramount. This article guides you through essential steps, focusing on merchant cash advance benefits as a fast business funding solution. We explore how these advances offer quick capital access, weighing the pros and cons of higher cost financing. Additionally, we delve into flexible repayment options crucial for sustainable growth, providing insights to help you make informed decisions.

- Understanding Your Business Needs: The First Step Towards Success

- Merchant Cash Advance Benefits: Unlocking Quick Capital Access

- Weighing the Pros and Cons of Short-Term Financing Solutions

- Exploring Flexible Repayment Options for Sustainable Growth

Understanding Your Business Needs: The First Step Towards Success

Understanding your business needs is a fundamental step towards achieving success and making informed decisions. Before diving into funding options, it’s crucial to pinpoint what your business requires at any given stage. This process involves evaluating both short-term and long-term goals, operational expenses, and cash flow patterns. Identifying these factors enables you to determine the most suitable financial strategy, be it a merchant cash advance offering fast business funding or exploring higher cost financing for more substantial projects.

By understanding your needs, you can leverage flexible repayment options that align with your business cycle. Quick capital access through alternative funding sources like merchant cash advances provides a short-term solution, while traditional loans might suit longer-term goals. This tailored approach ensures that your financial choices support the unique demands of your business, fostering growth and adaptability in today’s competitive landscape.

Merchant Cash Advance Benefits: Unlocking Quick Capital Access

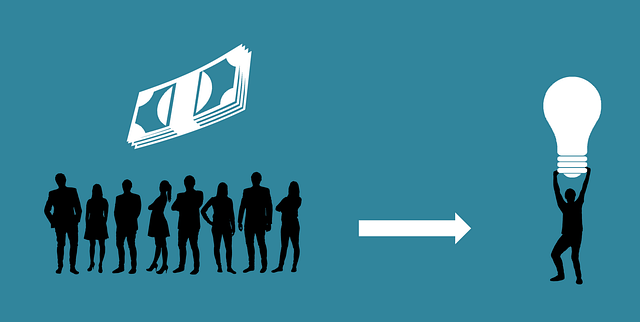

Merchant Cash Advances (MCAs) offer a unique and attractive option for businesses seeking fast funding. One of the key advantages is the unprecedented speed at which capital can be accessed. Unlike traditional loans that often involve lengthy application processes, credit checks, and waiting periods, MCAs provide an immediate solution. This quick capital access allows entrepreneurs to seize opportunities, fund unexpected expenses, or inject cash flow into their operations promptly.

Additionally, MCAs come with flexible repayment terms, making them a suitable short-term business funding option. Instead of fixed monthly payments, businesses can structure repayments based on a percentage of their daily credit card sales. This method aligns the repayment schedule with the business’s cash flow cycle, ensuring manageable and consistent payments. As a result, even higher cost financing through MCAs becomes a viable choice for those in need of quick capital without the burden of strict, long-term commitments.

Weighing the Pros and Cons of Short-Term Financing Solutions

When considering short-term financing solutions like a merchant cash advance (MCA), businesses must weigh both the benefits and drawbacks to determine if it aligns with their needs. MCAs offer significant advantages, such as fast business funding—often achieved within days of application—and flexible repayment options tailored to a company’s sales volume. This makes them an attractive short-term business solution for those seeking quick capital access without traditional banking routes.

However, it’s crucial to acknowledge the higher cost associated with MCAs compared to other financing methods. Interest rates and fees can be substantial, making this option less viable for long-term financial stability. Businesses should carefully consider their cash flow projections and ensure they can comfortably afford the faster repayment terms typically offered by MCAs, as these may present a financial challenge if sales are inconsistent or lower than anticipated.

Exploring Flexible Repayment Options for Sustainable Growth

In today’s dynamic business landscape, entrepreneurs and small business owners are constantly seeking sustainable growth strategies. One effective approach gaining traction is exploring flexible repayment options, particularly through innovative financing solutions like merchant cash advances (MCAs). MCAs offer a distinct advantage by providing quick capital access with minimal hassle, catering to the urgent financial needs of businesses. This fast business funding option is particularly appealing for short-term goals and working capital requirements, allowing companies to navigate unpredictable market conditions.

Traditional higher cost financing methods can be restrictive, imposing rigid repayment structures that might not align with a business’s cash flow patterns. In contrast, flexible repayment options associated with MCAs provide a more tailored approach. Businesses can manage their finances effectively by spreading out repayments over time, aligning with their sales cycles and revenue flows. This flexibility not only eases the financial burden but also empowers entrepreneurs to focus on core business activities, fostering growth and adaptability in an ever-changing market.