Businesses in volatile sectors like retail, hospitality, and services face fluctuating incomes due to seasonal demands, market trends, or events. To overcome this challenge, entrepreneurs must identify consistent trends through data analysis, customer behavior understanding, and industry insights. This proactive approach allows informed decisions on inventory, staffing, marketing, and operations, ensuring resilience during uncertain periods. Short-term business solutions, including flexible financing models like lines of credit or vendor financing, offer adjustable strategies to manage cash flow, adapt to market fluctuations, maintain competitiveness, and foster long-term growth in volatile economic climates. Pivoting offerings, optimizing pricing, and diversifying revenue are agile approaches that enhance resilience, ensure steady income, and prepare businesses for success amidst uncertainty.

In today’s dynamic economic landscape, businesses often grapple with fluctuating income patterns, posing significant challenges for cash flow management. This article explores strategies tailored for entities facing unpredictable revenue streams. We delve into understanding these income variations and highlight the immense value of short-term business solutions in stabilizing operations. By implementing dynamic strategies, companies can navigate financial volatility, ensuring resilience and sustained growth despite ever-changing market dynamics. Discover how agile approaches to revenue management can be a game-changer for businesses.

- Understanding Fluctuating Income Patterns: A Common Business Challenge

- The Benefits of Short-Term Business Solutions for Unpredictable Cash Flow

- Implementing Dynamic Strategies to Stabilize Revenue Streams

Understanding Fluctuating Income Patterns: A Common Business Challenge

Many businesses, especially those in retail, hospitality, and certain service industries, face the challenge of fluctuating income patterns. This unpredictability can stem from various factors like seasonal demands, market trends, or one-off events. For entrepreneurs and business owners, managing such volatility is a constant struggle, often requiring agile strategies to adapt to changing financial landscapes.

Identifying consistent trends within the fluctuations is key to implementing a short-term business solution. By analyzing sales data, understanding customer behavior, and remaining attuned to industry insights, businesses can anticipate peaks and valleys. This foresight enables them to make informed decisions on inventory management, staffing, marketing, and operational adjustments, ultimately ensuring resilience during uncertain periods.

The Benefits of Short-Term Business Solutions for Unpredictable Cash Flow

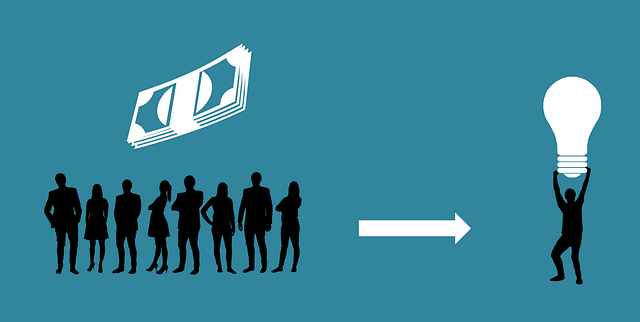

For businesses grappling with unpredictable income, securing consistent cash flow can be a significant challenge. This is where short-term business solutions prove invaluable. These flexible options cater to the unique needs of volatile markets and changing consumer behaviors, offering businesses a safety net during uncertain periods. By implementing short-term strategies, companies can efficiently manage their financial resources, ensuring they have the capital on hand when it matters most.

One of the primary advantages is the ability to adapt swiftly to market fluctuations. Short-term solutions often involve adjustable financing models, such as line of credits or vendor financing, enabling businesses to scale operations up or down based on demand. This agility allows companies to stay competitive and responsive in a dynamic business landscape, ultimately contributing to long-term stability and growth.

Implementing Dynamic Strategies to Stabilize Revenue Streams

In the face of fluctuating income, businesses often find themselves in need of adaptable strategies to ensure financial stability. Implementing dynamic approaches is a strategic move for short-term business solutions, enabling companies to navigate unpredictable market conditions. By adjusting their revenue streams in real-time, businesses can mitigate risks and capitalize on emerging opportunities. This might involve quickly pivoting products or services to meet shifting consumer demands, optimizing pricing strategies based on market trends, or diversifying income sources to reduce reliance on a single stream.

Such dynamic strategies empower companies to respond swiftly to changes in their industry. They offer a practical short-term business solution by enhancing agility and flexibility. Through constant monitoring and proactive adjustments, businesses can ensure a steady revenue flow, even during periods of uncertainty. This not only helps sustain operations but also paves the way for long-term growth and resilience.