In today's unpredictable business environment, Merchant Cash Advances (MCAs) offer a swift and flexible financial safety net. MCAs provide fast business funding, with approval in days rather than weeks, and flexible repayment options tied to sales volume, making them ideal for businesses experiencing fluctuating cash flow. This short-term solution avoids the rigidity of higher cost financing methods associated with traditional loans, allowing entrepreneurs to access quick capital without long-term debt obligations.

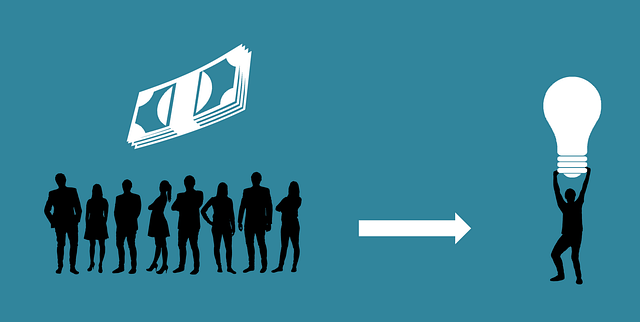

Urgent financial needs and gaps in businesses can be challenging, but there’s a powerful tool that offers a swift solution: Merchant Cash Advance Benefits. This article explores how this quick business funding option caters to immediate cash flow issues. We delve into the advantages of fast business funding, including flexible repayment terms and streamlined access to capital. Additionally, we examine higher cost financing as a short-term strategy for urgent needs, providing insights into managing financial crises effectively.

- Understanding Urgent Financial Needs and Gaps in Businesses

- Merchant Cash Advance Benefits: A Quick Business Funding Option

- Fast Business Funding: How Does it Help in Short-Term Financial Crises?

- Flexible Repayment Options for Better Financial Management

- Quick Capital Access: Streamlining the Funding Process

- Higher Cost Financing as a Short-Term Solution for Urgent Needs

Understanding Urgent Financial Needs and Gaps in Businesses

In the dynamic landscape of business, urgent financial needs and gaps can arise unexpectedly, demanding immediate attention. These may include unforeseen expenses, sudden market fluctuations, or rapid growth phases that strain traditional funding sources. For many businesses, especially small and medium-sized enterprises (SMEs), addressing these challenges requires agile financial solutions. Here, a merchant cash advance (MCA) stands out as a game-changer, offering fast business funding with minimal paperwork.

MCAs provide quick capital access, allowing business owners to tap into their future sales revenue. This alternative financing method is particularly appealing due to its flexible repayment options. Unlike higher cost financing that locks you into rigid terms, MCAs let you make payments based on your actual sales volume, aligning repayment with cash flow. As a short-term business solution, it offers both speed and flexibility, helping businesses navigate through urgent financial needs without the burden of traditional loans.

Merchant Cash Advance Benefits: A Quick Business Funding Option

When business owners face urgent financial needs and gaps, a Merchant Cash Advance (MCA) can offer a quick and flexible funding solution. One of the primary merchant cash advance benefits is its speed. Unlike traditional loans that require extensive paperwork and lengthy approval processes, MCAs provide fast capital access. This means that businesses can get the money they need within days, making it an ideal short-term business solution for urgent matters.

Another advantage of MCAs is their flexible repayment options. Instead of fixed monthly payments, businesses repay the advance as a percentage of their daily credit card sales. This aligns with cash flow patterns, allowing for more manageable repayments. Moreover, since MCAs are based on future credit card sales, they can be seen as a higher cost financing option, but for many businesses, the quick capital access and flexible terms outweigh the higher costs in the short term.

Fast Business Funding: How Does it Help in Short-Term Financial Crises?

In today’s dynamic business landscape, unexpected financial crises can arise at any moment, leaving entrepreneurs scrambling for solutions. This is where fast business funding steps in as a lifeline, offering businesses a swift and efficient way to bridge short-term gaps. A merchant cash advance, a prominent form of fast business funding, provides immediate access to capital, enabling businesses to navigate through turbulent financial periods. Unlike traditional loans, these advances are not tied to collateral or complex application processes, making them an attractive option for time-sensitive needs.

The primary advantage lies in their flexibility and speed. Businesses can secure funds within a short timeframe, often receiving the money within days of approval. This rapid capital access allows entrepreneurs to seize opportunities, cover unexpected expenses, or manage cash flow shortages. Moreover, flexible repayment options cater to the unique needs of various businesses, ensuring that repayment aligns with revenue cycles. Unlike higher cost financing methods, these advances provide a short-term business solution without the burden of long-term debt, making them an ideal choice for those seeking immediate relief from financial crises.

Flexible Repayment Options for Better Financial Management

One of the key advantages of merchant cash advances is their flexibility in terms of repayment options. Unlike traditional loans that often come with rigid repayment structures, this fast business funding option allows entrepreneurs to tailor their repayments to suit their cash flow patterns. This short-term financial solution enables businesses to manage their finances more effectively, as they can spread out payments over time, aligning with periods of higher revenue or when cash is more readily available.

This flexibility is particularly beneficial for small businesses or startups that experience fluctuations in sales throughout the year. With flexible repayment options, business owners can avoid the strain of making large, one-time payments and instead opt for smaller, consistent installments. This approach helps to mitigate the higher cost financing associated with short-term solutions and ensures a more sustainable financial path. As a result, merchants can focus on growing their businesses without the added worry of immediate repayment demands.

Quick Capital Access: Streamlining the Funding Process

In today’s fast-paced business environment, having quick access to capital can be a game-changer for entrepreneurs and small businesses facing urgent financial needs. One effective solution that has gained popularity is the merchant cash advance (MCA), offering a unique set of benefits tailored to the challenges of modern commerce. Unlike traditional loans, MCAs provide funding by using future credit card sales as collateral, ensuring a streamlined and efficient process for business owners in need of fast capital. This alternative financing method is particularly attractive for those seeking flexible repayment options that align with their revenue cycles, eliminating the burden of fixed monthly payments during lean periods.

The benefits extend beyond rapid funding. MCAs often come with transparent terms, allowing businesses to focus on their core operations without the added stress of complex financial obligations. This short-term business solution can bridge the gap between sudden expenses and the arrival of revenue streams, offering a higher cost financing option that is simpler and more accessible than traditional bank loans. With its quick capital access, this method empowers business owners to seize opportunities, navigate unexpected challenges, and ultimately drive growth without compromising their financial stability.

Higher Cost Financing as a Short-Term Solution for Urgent Needs

When businesses face urgent financial needs or unexpected gaps in cash flow, opting for higher cost financing can serve as a strategic short-term solution. Unlike traditional loans, merchant cash advances offer fast business funding with relatively simple application processes, making them easily accessible to many companies. This type of financing is particularly beneficial for small and medium-sized enterprises (SMEs) that may not have the robust financial history or collateral required by banks for standard business loans.

One of the key advantages of merchant cash advances lies in their flexible repayment options. Repayments are typically tied to a percentage of daily sales, allowing businesses to align debt service with their cash flow patterns. This approach provides businesses with quick capital access and the freedom to focus on meeting short-term financial obligations without the burden of rigid repayment schedules. As a result, higher cost financing can be an effective short-term business solution for urgent needs, offering both speed and flexibility in funding.